California Wildfire Season Intensifies Without Key Factor, Raising Concerns for the Coming Months

California has faced a severe wildfire season fueled by heat and dried-out vegetation, even without the seasonal winds that typically escalate fire risks. Experts warn that conditions could worsen as fall progresses.

September 24, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

California

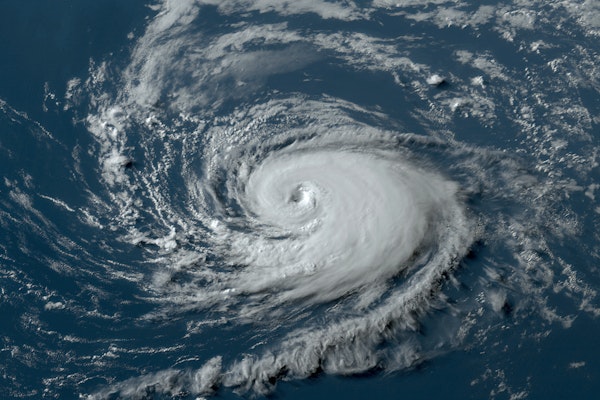

Hurricane Threat Looms for Gulf Coast as Atlantic Storm Intensifies

A developing Atlantic storm poses a significant hurricane risk to the US Gulf Coast, stretching from Mississippi to Florida. Forecasters predict rapid intensification as it moves north through warm Gulf waters, threatening major landfall.

September 23, 2024

Catastrophe

Litigation

Property

Risk Management

Florida

Mississippi

California Firefighter Arrested for Allegedly Starting Five Brush Fires in Northern California

A firefighter in Northern California has been arrested for allegedly starting five brush fires while off duty, raising concerns about internal misconduct within fire agencies.

September 23, 2024

Catastrophe

Legislation & Regulation

Litigation

Property

California

New Jersey Supreme Court Expands Duty of Care for Sidewalks Next to Vacant Commercial Properties

The New Jersey Supreme Court ruled that commercial landowners, including those with vacant properties, must maintain public sidewalks abutting their properties in safe condition, aligning with broader public policy principles.

September 23, 2024

Legislation & Regulation

Liability

Litigation

Property

New Jersey

Climate Change Drives Global Surge in Fires, Floods, and Drought

The impact of climate change is becoming more visible worldwide, with intensifying wildfires, severe droughts, and devastating floods affecting regions from Brazil to Southeast Asia.

September 19, 2024

Catastrophe

Litigation

Property

Risk Management

California

North Carolina

Homeowners Insurance Costs Surge Across the U.S., Florida Takes the Lead with Soaring Rates

Homeowners across the U.S. are facing sharp insurance premium hikes, with Florida seeing the steepest increases, fueled by hurricane risks, fraud, and lack of competition.

September 18, 2024

Catastrophe

Litigation

Property

Risk Management

Florida

Louisiana

Texas

Parametric Insurance Protects Surf Ecosystems as Global Surfing Economy Booms

A groundbreaking parametric insurance model is being used to safeguard surf ecosystems from environmental damage, starting in El Salvador, as part of a global effort to protect valuable natural resources.

September 18, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Fed Rate Cut to Boost Insurance Portfolios, Affect Premiums and Underwriting

The Federal Reserve’s unexpected rate cut could boost insurance portfolios, while potentially increasing premiums and altering underwriting practices across the sector.

September 18, 2024

Insurance Industry

Life & Health

Property

Underwriting

U.S. Property and Casualty Insurers Achieve $3.8 Billion Underwriting Gain in H1 2024

The U.S. property and casualty insurance sector posted a $3.8 billion underwriting gain in H1 2024, rebounding from a $24 billion loss last year, driven by premium growth and improved catastrophe losses.

September 17, 2024

Catastrophe

Insurance Industry

Property

Risk Management

US Property Insurance Rates Fall for the First Time Since 2017 as Insurers Return to Profitability

Property insurance rates in the US have dropped for the first time since 2017, driven by insurers’ return to profitability following lower catastrophe-related losses and stronger market conditions.

September 17, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida Home Inspector Accused of Reusing Photos in 200+ Insurance Inspections, Costing $88,000

A Florida home inspector is accused of using identical stock photos in over 200 inspections, costing Citizens Property Insurance Corp. thousands in fraudulent premiums and reinspection costs.

September 13, 2024

Fraud

Insurance Industry

Legislation & Regulation

Property

Florida

How AI-Powered Digital Twins Are Shaping the Future of P/C Insurance

AI-enabled digital twins are revolutionizing how property and casualty insurers assess risk and protect policyholders from climate-related damages, offering enhanced accuracy and predictive capabilities.

September 13, 2024

Catastrophe

Property

Risk Management

Technology

Investigators Sound Alarm on Fraudulent Water Damage Claims

Insurance fraud experts warn about exaggerated or false water damage claims, often linked to home renovations and fake sewage leaks, aimed at inflating insurance payouts.

September 13, 2024

Catastrophe

Fraud

Litigation

Property

California

Florida

Hurricane Francine Risks $1.5 Billion in Insured Losses as it Strikes Louisiana

Hurricane Francine made landfall in Louisiana as a Category 2 storm, with CoreLogic estimating insured losses at up to $1.5 billion, impacting residential and commercial properties across the Gulf Coast.

September 13, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Kentucky

Louisiana

Mississippi

Missouri

Louisiana Residents Begin Cleanup After Hurricane Francine’s Devastation

Residents across southern Louisiana are starting the cleanup process following Hurricane Francine, which brought 100-mph winds, severe flooding, and widespread storm surge damage to coastal communities.

September 12, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Louisiana