Clorox Sues Cognizant Over Password Failures in 2023 Cyberattack

Clorox claims Cognizant failed basic security protocols, allowing hackers to access its network during a 2023 cyberattack that led to $380 million in damages.

July 23, 2025

Insurance Industry

Litigation

Risk Management

Technology

California

Cybersecurity Insurance Market Set to Surpass $32 Billion by 2030 Amid Rising Threats

Cyber insurance is on track to more than double in market value by 2030, driven by rising cyberattacks, new regulations, and demand for integrated risk solutions.

July 21, 2025

Insurance Industry

Risk Management

Technology

Insurers Embrace Agentic AI as Trust and Risk Take Center Stage

Insurers are piloting agentic AI to streamline claims and underwriting, but widespread adoption is slowed by trust, privacy concerns, and regulatory readiness gaps.

July 21, 2025

Insurance Industry

Risk Management

Technology

Underwriting

U.S. Wildfires and Storms Push Global Insured Catastrophe Losses to $100 Billion in First Half of 2025

Aon’s midyear catastrophe recap shows $100 billion in insured losses—second-highest ever—driven by U.S. wildfires, convective storms, and a costly earthquake in Myanmar.

July 17, 2025

Catastrophe

Insurance Industry

Property

Risk Management

California

Missouri

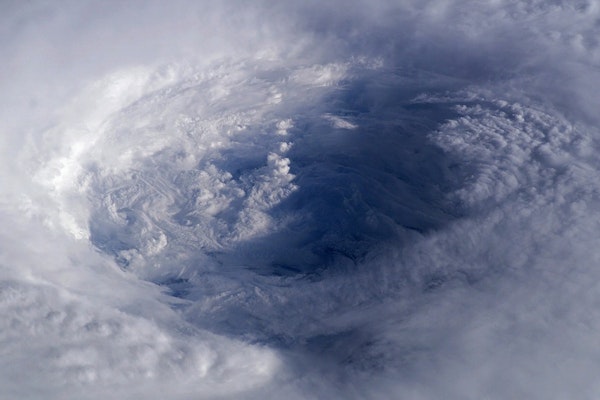

Why the U.S. Faces Soaring Hurricane Losses as Storms Grow Stronger

With climate change intensifying storms, insured hurricane losses in the U.S. could surge 50%—testing the limits of insurers, infrastructure, and public preparedness.

July 17, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Massachusetts

New York

Texas

Fans Injured in FedEx Field Railing Collapse Reach Settlement With Washington Commanders

Four fans injured during a 2022 NFL game when a railing gave way at FedEx Field have settled negligence claims against the Washington Commanders following arbitration proceedings.

July 17, 2025

Insurance Industry

Liability

Litigation

Risk Management

Maryland

Soaring Temperatures Drive Surge in Workplace Heat-Related Injuries

A new report from WCRI shows workplace injury claims rise dramatically on hot days, with heat-related illnesses up to 18 times more common above 100 degrees Fahrenheit.

July 17, 2025

Education & Training

Legislation & Regulation

Risk Management

Workers' Compensation

Arizona

Arkansas

Louisiana

Mississippi

Texas

Gulf System Could Become Tropical Storm Dexter as Development Chances Rise

A low-pressure system moving from Florida into the Gulf may strengthen into Tropical Storm Dexter later this week, bringing heavy rain and flooding risks across the region.

July 15, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Mississippi

Texas

How a Warmer Climate Could Drive a 39% Surge in U.S. Hurricane Insurance Losses

A new scenario analysis reveals that insured U.S. hurricane losses could rise by nearly 40 percent under a 2 degrees Celsius warmer climate, with the greatest relative impacts along the East Coast.

July 15, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Zuckerberg to Testify in $8 Billion Trial Alleging Facebook Misled Users and Shareholders

Mark Zuckerberg is set to testify in an $8 billion shareholder lawsuit alleging Facebook ignored a 2012 FTC order and misled users about privacy following the Cambridge Analytica scandal.

July 15, 2025

Insurance Industry

Litigation

Risk Management

Technology

How Aging Workers Are Reshaping the Complexity of Workers Compensation Claims

With more Americans over 55 staying in the workforce, injury claims are growing more complex due to slower recovery, comorbidities, and social health factors.

July 14, 2025

Risk Management

Technology

Workers' Compensation

Hail Causes Over Half of Solar PV Weather Claims in North America According to AXIS Capital Report

Hail is the leading driver of solar PV natural catastrophe claims in North America, with AXIS Capital urging better forecasting and resilient system design to reduce losses.

July 12, 2025

Catastrophe

Property

Risk Management

Technology

Georgia Countertop Manufacturer Fined for Exposing Workers to Dangerous Silica Dust

OSHA cited Brazilian Stone Design LLC with seven serious violations after determining employees were exposed to unsafe levels of respirable crystalline silica on the job.

July 12, 2025

Legislation & Regulation

Property

Risk Management

Workers' Compensation

Georgia

New Report Ranks Safest and Riskiest U.S. Cities for Drivers in 2025

Allstate’s 2025 America’s Best Drivers Report reveals which U.S. cities saw the greatest improvements and setbacks in collision rates based on auto claims data.

July 10, 2025

Auto

Property

Risk Management

Technology

Why Coreless Architecture Is the Key to Scalable AI in Insurance

Insurers are adopting coreless architecture to scale AI, enhance digital servicing, and meet regulatory demands without discarding legacy core systems or disrupting operations.

July 10, 2025

Insurance Industry

Risk Management

Technology

Underwriting