Warner Bros. Discovery Wins Dismissal of Superman Copyright Lawsuit Ahead of Movie Release

A U.S. judge dismissed a copyright lawsuit against Warner Bros. Discovery involving Superman’s international rights, clearing legal hurdles before the new film’s July release.

April 29, 2025

Insurance Industry

Legislation & Regulation

Litigation

Risk Management

New York

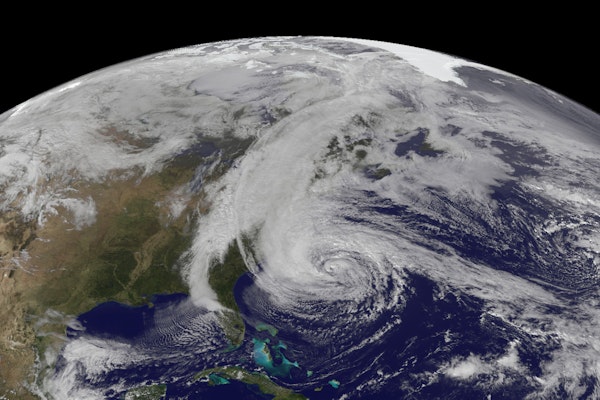

Natural Catastrophe Insurance Losses Could Hit $145 Billion in 2025 as Peak Loss Risk Grows

Global catastrophe insurance losses are projected to grow steadily, with a 1-in-10 chance of topping $300 billion in 2025, driven by climate change, urbanization, and rising exposure values.

April 29, 2025

Catastrophe

Insurance Industry

Property

Risk Management

2025 Southeast Texas Hurricane Guide Released for Upcoming Season

The National Weather Service Houston/Galveston office has published the 2025 Hurricane and Severe Weather Guide, offering Southeast Texas residents crucial preparedness tips for the season ahead.

April 28, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Texas

States in Hurricane Zones Face Bigger Disaster Costs as Federal Support Shrinks

States like Maryland are preparing for a busier hurricane season with fewer FEMA resources after nationwide cuts to disaster mitigation funding and staffing.

April 28, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Maryland

Georgia Fraud Investigation Results in Over 180 Felony Charges Against Eight Individuals

Authorities in Chatham County charged eight people with over 180 felonies after they allegedly used an elderly victim’s personal information to commit identity theft and insurance fraud.

April 28, 2025

Fraud

Insurance Industry

Litigation

Risk Management

North Carolina

Trump Administration Eases Crash Reporting Rules for Partial Self-Driving Cars, Boosting Tesla

New federal rules will reduce crash reporting requirements for Level 2 self-driving vehicles, a change expected to benefit Tesla while raising transparency concerns.

April 28, 2025

Auto

Legislation & Regulation

Risk Management

Technology

Vehicle Thefts Drop to Historic Low in 2024

The U.S. saw fewer than one million vehicle thefts in 2024—a 16.7% drop from 2023 and the biggest decline in four decades, with Kia and Hyundai models leading theft stats.

April 23, 2025

Auto

Fraud

Property

Risk Management

How Certificates of Insurance Help Fight Freight Fraud in the Supply Chain

Freight fraud is rising, costing companies millions. Requiring and verifying certificates of insurance is proving vital for reducing risk and increasing trust across the supply chain.

April 23, 2025

Fraud

Insurance Industry

Risk Management

Technology

Iowa

Nevada

New Jersey Wildfire Grows to 8,500 Acres as Evacuations and Power Outages Mount

The Jones Road Wildfire near Toms River has burned 8,500 acres with less than 10% containment, prompting evacuations and threatening over 1,000 structures in Ocean County, New Jersey.

April 23, 2025

Catastrophe

Insurance Industry

Property

Risk Management

New Jersey

FBI Reports Global Cybercrime Losses Surpass $16 Billion in 2024

Cybercrime cost victims over $16 billion last year, driven by online scams like phishing and tech support fraud, with most complaints originating from the U.S.

April 23, 2025

Fraud

Insurance Industry

Risk Management

Technology

Neutral Pacific Waters Signal Potential Spike in Atlantic Hurricanes

With La Niña officially over and El Niño unlikely, the Atlantic may face an active hurricane season as neutral Pacific conditions remove key storm barriers.

April 21, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Florida

Louisiana

Mississippi

Texas

New York Court Blocks City’s Attempt to Recoup Firefighter Injury Payments After Retirement

A New York court has ruled that post-retirement pension supplements paid to an injured firefighter are not subject to reimbursement under workers’ compensation laws.

April 21, 2025

Liability

Litigation

Risk Management

Workers' Compensation

New York

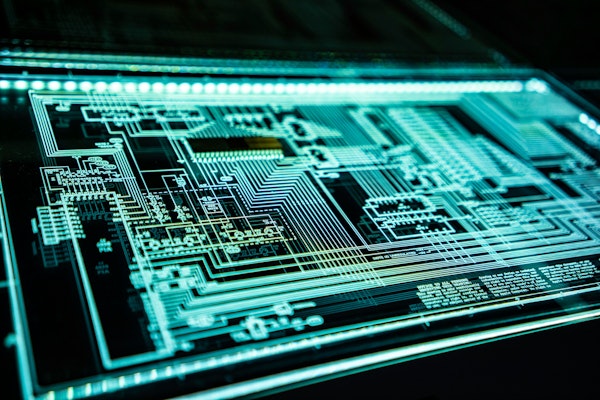

Reimagining Claims with AI: A Practical Path from Manual to Autonomous Workflows

Insurance leaders are stepping into a new claims era—where AI-driven coworkers transform workflows, elevate adjuster roles, and future-proof operations through autonomy.

April 21, 2025

Education & Training

Insurance Industry

Risk Management

Technology

How Agentic AI Is Transforming Insurance and Financial Services with Next Best Action Technology

Agentic AI is reshaping insurance and financial services by empowering digital coworkers to drive timely, compliant, and actionable decisions at scale.

April 18, 2025

Property

Risk Management

Technology

California

How Rising Climate Risks Are Reshaping Insurance for Renewable Energy Projects Worldwide

As natural catastrophe and extreme weather losses escalate globally, insurers, developers, and financiers must rethink risk management to keep renewable energy projects insurable and bankable.

April 15, 2025

Catastrophe

Insurance Industry

Property

Risk Management