Florida Matches Record Hurricane Landfalls in 2024, Reports Howden Re

The 2024 Atlantic hurricane season, marked by record Florida landfalls and extreme storm activity, ranks among the most impactful in recent history, Howden Re reports.

December 5, 2024

Catastrophe

Property

Risk Management

Technology

Florida

North Carolina

Tennessee

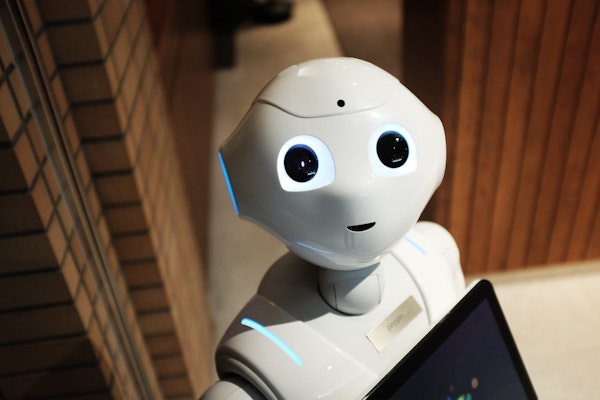

Emerging Trends in Workers’ Compensation Insurance for 2025

In 2025, workers’ compensation insurance will see advancements in AI, wearable tech, and remote work policies, alongside a focus on personalized claims management and safety programs.

December 4, 2024

Insurance Industry

Risk Management

Technology

Workers' Compensation

Artificial Intelligence in Insurance: Navigating Regulation and Ethical Oversight

As insurers increasingly adopt artificial intelligence, global regulators are stepping up oversight, emphasizing ethics, compliance, and transparency to mitigate risks and ensure responsible innovation.

December 4, 2024

Insurance Industry

Legislation & Regulation

Risk Management

Technology

AI Brings Speed, Precision, and Control to Insurance Operations

Artificial intelligence is transforming the insurance industry by automating processes, enhancing fraud detection, personalizing policies, and streamlining customer service.

December 4, 2024

Fraud

Risk Management

Technology

Underwriting

Insurance Customers Embrace Digital Claims, Driving Satisfaction Gains

Insurance customers are increasingly satisfied with digital claims processes, thanks to mobile app improvements like collision reporting, image uploads, and seamless navigation tools.

December 4, 2024

Auto

Insurance Industry

Property

Technology

Annual Claim Department Review: 13 Areas to Strengthen Operations

An annual operational review of claims departments is essential to improve efficiency, ensure compliance, and deliver exceptional customer service in an evolving insurance industry.

December 3, 2024

Insurance Industry

Risk Management

Technology

Commercial Insurance Market Holds Steady Amid Pricing, Underwriting Gains

Strong underwriting and moderate pricing gains sustain profitability in U.S. commercial insurance, despite pressures from casualty claims, social inflation, and evolving liabilities.

December 3, 2024

Liability

Property

Risk Management

Technology

Insurance Faces Data Challenges in Climate Risk Planning

Fragmented data sources and limited integration are stalling the insurance industry’s ability to address climate risks, experts emphasize at the Global Insurance Forum.

December 2, 2024

Catastrophe

Legislation & Regulation

Risk Management

Technology

Florida

The Changing Role of Source Code Escrows in Cloud-Driven Insurance IT

As cloud computing reshapes IT operations, the traditional value of source code escrows is diminishing, prompting insurance CIOs to rethink business continuity and vendor risk strategies.

December 2, 2024

Insurance Industry

Legislation & Regulation

Risk Management

Technology

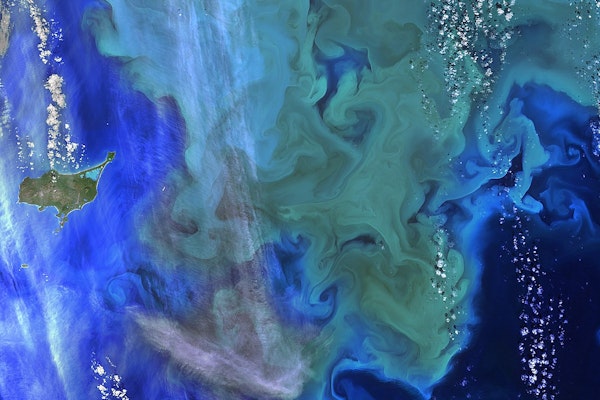

AI Tool Creates Accurate Satellite Images Predicting Floods

MIT researchers combine generative AI and physics models to create realistic satellite images of future floods, enhancing readiness and emergency planning.

December 2, 2024

Catastrophe

Insurance Industry

Risk Management

Technology

Texas

Bridging the Gap Between AI and Human Touch in Customer Experience

Businesses must strike a balance between innovative AI tools and human intuition to meet evolving customer expectations and deliver exceptional experiences.

December 2, 2024

Auto

Insurance Industry

Technology

Ransomware Attack Forces Starbucks to Manually Track Employee Hours

A ransomware attack on Blue Yonder, a software provider for scheduling and supply chain management, disrupted Starbucks’ systems, forcing manual payroll and scheduling for workers in North America.

November 26, 2024

Insurance Industry

Risk Management

Technology

Workers' Compensation

Arizona

New York High Court Enforces Uber’s Arbitration Clause Despite Preexisting Injury Lawsuit

New York’s highest court has upheld Uber’s arbitration requirement in a case involving a preexisting injury lawsuit, ruling the company’s clickwrap agreement is a valid contract.

November 26, 2024

Legislation & Regulation

Liability

Litigation

Technology

California

Connecticut

Illinois

Massachusetts

New York

New York Penalizes GEICO and Travelers Over Auto Insurance Cybersecurity Breaches

New York imposes $11.3M in fines on GEICO and Travelers after data breaches exposed personal information of over 120,000 customers, citing insufficient cybersecurity controls.

November 26, 2024

Auto

Legislation & Regulation

Liability

Technology

New York

Top Insurance Risk Concerns Revealed in RiskScan 2024 Report

RiskScan 2024 highlights how cyber incidents, climate change, and economic inflation dominate risk concerns across insurers, businesses, and consumers, revealing critical gaps in awareness.

November 26, 2024

Education & Training

Property

Risk Management

Technology