Georgia’s Auto Insurance Costs Surge, Now Among the Least Affordable in the U.S.

Georgia has become one of the least affordable states for auto insurance, with rising costs driven by factors such as legal system abuse, uninsured motorists, and increased litigation, according to a recent IRC study.

August 12, 2024

Auto

Legislation & Regulation

Litigation

Risk Management

Florida

Georgia

Louisiana

Mississippi

New York

Tech Giants Counter Delta Air Lines’ Blame Over Flight Cancellations

Delta’s claims against Microsoft and CrowdStrike are misleading, say tech giants.

August 7, 2024

Insurance Industry

Litigation

Risk Management

Technology

Georgia

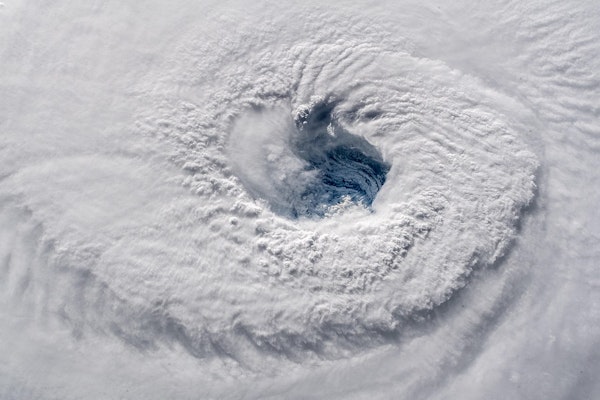

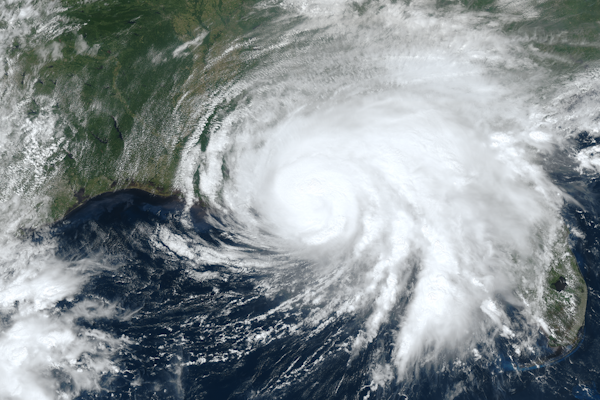

Hurricane Debby Hits Florida’s Big Bend, Promises Severe Southeast Flooding

Hurricane Debby has made landfall in Florida’s Big Bend with maximum sustained winds of 80 mph, leading to potential historic flooding from northern Florida to the Carolinas, along with gusty winds, storm surge, and tornadoes.

August 5, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

Virginia

Georgia Roofing Subcontractor Fined After Teen Falls from Roof

JVS Roofing faces penalties for employing a minor in hazardous work and underpaying workers after a 17-year-old fell from a Pennsylvania roof.

July 29, 2024

Georgia

NBA Teams Sued for Copyright Infringement in Social Media Videos

Fourteen NBA teams are accused of using copyrighted music in social media promotional videos without proper licensing, leading to multiple lawsuits by Kobalt and other music companies.

July 23, 2024

Insurance Industry

Legislation & Regulation

Litigation

Technology

Arizona

California

Colorado

Florida

Georgia

Insurers Gained $50 Billion From Medicare for Untreated Diseases

Medicare Advantage insurers received $50 billion from questionable diagnoses, including diseases like diabetic cataracts and HIV, for conditions that were not treated or didn’t exist.

July 8, 2024

Fraud

Insurance Industry

Legislation & Regulation

Technology

Alabama

Arizona

Florida

Georgia

Massachusetts

AI Helps Cut Workers Comp Costs by Identifying Fraud and Difficult Claims

Artificial intelligence is aiding insurers and employers in reducing workers comp costs by identifying difficult and fraudulent claims, but it remains a tool for claims handlers rather than a replacement.

July 8, 2024

Fraud

Insurance Industry

Technology

Workers' Compensation

California

Georgia

Massachusetts

Missouri

Farmers Insurance Addresses Adjuster Concerns Following Anonymous Letter

Farmers Insurance responds to claims of understaffing and overworking made by an anonymous group of in-house adjusters, following a significant increase in claims and workforce reduction.

July 2, 2024

Insurance Industry

Legislation & Regulation

Litigation

Workers' Compensation

Alabama

California

Florida

Georgia

Tennessee

Lightning-Related Insurance Claims Soar in 2023

The Insurance Information Institute (Triple-I) reported a 30% increase in total claims value from 2022, highlighting the financial impact of severe convective storms.

June 19, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

California

Florida

Georgia

Louisiana

Nuclear Verdicts Surge in Personal Injury and Wrongful Death Cases: A Decade in Review

A comprehensive study from the U.S. Chamber of Commerce Institute for Legal Reform highlights the rising trend of nuclear verdicts, their causes, and potential solutions over a ten-year period ending in 2022.

June 10, 2024

Legislation & Regulation

Litigation

Property

Risk Management

California

Florida

Georgia

Illinois

Missouri

Insights from Allianz Atlantic Hurricane Forecast

The 2024 Atlantic hurricane season, starting June 1 and ending November 30, is predicted to be particularly active. Allianz Commercial offers insights into this year’s forecast, reviewing notable 2023 storms and providing expert advice on storm preparedness.

June 6, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

Cargo Theft Expected to Increase Over Memorial Day Weekend

Prepare for a spike in cargo thefts this Memorial Day weekend with these essential tips from CargoNet.

May 24, 2024

Fraud

Property

Risk Management

Technology

California

Florida

Georgia

Texas

Florida’s Property Insurance Market Shows Signs of Stabilization in 2024

The Florida Office of Insurance Regulation reports a downward trend in property insurance rates for 2024, indicating market stabilization due to recent reforms.

May 21, 2024

Insurance Industry

Legislation & Regulation

Property

Risk Management

Florida

Georgia

Hawaii

Louisiana

Woman Indicted on 51 Fraud Counts Over False Property Ownership Claims

A Georgia woman was indicted on 51 counts of fraud for filing false property claims in Virginia, including Indiantown Park and historic Eyre Hall.

May 21, 2024

Fraud

Legislation & Regulation

Litigation

Property

Georgia

Virginia

Houston Power Outages Could Last Weeks After Deadly Hurricane-Force Winds

Power outages in Houston could last for weeks following a destructive storm with hurricane-force winds, leaving thousands without electricity amid soaring temperatures.

May 17, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Florida

Georgia

Louisiana

Mississippi