Texas Sees Sharp Rise in Catalytic Converter Theft as Criminals Target High-Value Metals

Catalytic converter thefts are soaring across Texas, with Tarrant County hit especially hard. Learn why thieves target these parts and how to protect your vehicle.

August 20, 2025

Auto

Legislation & Regulation

Property

Risk Management

Texas

Cyberattacks and Satellite Threats Highlight Growing Risks in Space-Based Warfare

Satellite hacks and emerging nuclear weapons in space reveal rising global tensions, as U.S., Russia, and China compete for military and economic control beyond Earth.

August 20, 2025

Legislation & Regulation

Risk Management

Technology

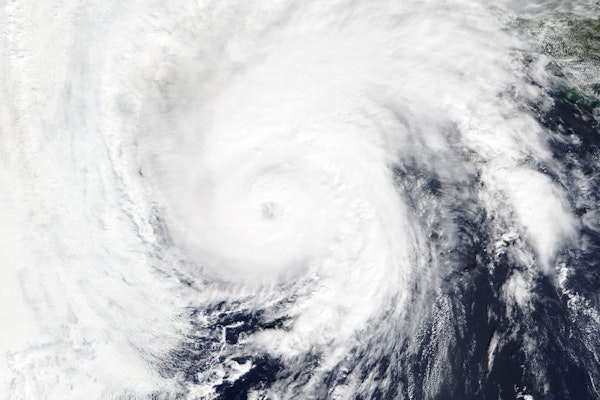

Hurricane Erin Threatens East Coast with Life-Threatening Surf and Evacuations Ordered in North Carolina

Hurricane Erin, now a powerful Category 4 storm, is forecast to bring dangerous surf and rip currents to the eastern U.S., prompting mandatory evacuations in coastal North Carolina.

August 18, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

North Carolina

Delivery Drones Are Expanding Rapidly as Safety, Cost, and Regulatory Challenges Persist

As FAA regulations evolve, drone delivery is scaling to more U.S. cities, though high costs, airspace safety, and privacy concerns continue to slow full adoption.

August 14, 2025

Legislation & Regulation

Property

Risk Management

Technology

Arizona

Florida

Georgia

Kansas

Missouri

Cyber Insurance Market Expands as AI and Financial Fraud Reshape Risk Landscape

With premium drops, rising capacity, and AI-driven threats, the cyber insurance market in 2025 presents both opportunities and volatility for adjusters and carriers alike.

August 14, 2025

Education & Training

Insurance Industry

Risk Management

Technology

Nonprofit Revives NOAA Billion-Dollar Disaster Data to Support Risk Modeling

Climate Central will take over the halted NOAA database of billion-dollar disasters, expanding its scope to support insurers, researchers, and public safety planning.

August 14, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Why Outdated Payment Systems Are Holding P&C Insurers Back

Outdated and siloed payment systems are costing P&C insurers in efficiency, customer trust, and compliance—modernizing them is now a strategic necessity.

August 14, 2025

Insurance Industry

Property

Risk Management

Technology

Record-Breaking Insured Losses in 2025 Highlight Growing Impact of U.S. Wildfires and Storms

The first half of 2025 brought $84 billion in insured catastrophe losses, driven by U.S. wildfires and severe convective storms, making it the costliest H1 since 2011.

August 14, 2025

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

New Jersey

New York

North Carolina

Aon Sued Over Alleged Fraud in Vesttoo Credit Insurance Dealings

A creditor trust for bankrupt AI firm Vesttoo has sued Aon, claiming the broker committed fraud while promoting credit insurance linked to a failed funding scheme.

August 14, 2025

Fraud

Insurance Industry

Litigation

Risk Management

Tropical Storm Erin on Track to Become Hurricane with Impacts Likely in Northern Caribbean

Tropical Storm Erin may strengthen into a hurricane by Friday, with potential impacts including high surf and rip currents in the northern Leeward Islands, Virgin Islands, and Puerto Rico.

August 14, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Columbia University Data Breach Impacts 870,000 People With Personal, Academic, and Financial Details Exposed

Columbia University reports a cyberattack compromising personal, academic, and financial data of nearly 870,000 individuals, with investigations and notifications ongoing.

August 11, 2025

Education & Training

Insurance Industry

Risk Management

Technology

California

Maine

NOAA Maintains Above-Normal Hurricane Season Outlook With Updated 2025 Forecast

NOAA’s updated 2025 Atlantic hurricane forecast still calls for above-normal activity, with 13-18 named storms expected and up to five major hurricanes possible.

August 8, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Why Maryland Has the Highest Car Insurance Rates in the Nation

Maryland drivers pay the highest auto insurance rates in the U.S., with premiums driven by urban congestion, repair costs, extreme weather, and frequent claims.

August 7, 2025

Auto

Property

Risk Management

Technology

Maryland

Mastering Property Claim Investigations with Subject Matter Experts

A guide to working effectively with subject matter experts in property claims—from basic investigations to litigation-ready forensic reports and cost analyses.

August 7, 2025

Education & Training

Litigation

Property

Risk Management

Breaking Down Data Barriers to Strengthen AI Risk Management

Insurers, tech companies, and businesses must securely share data and align strategies to manage AI risks, prevent losses, and support responsible innovation.

August 7, 2025

Insurance Industry

Liability

Risk Management

Technology