P&C Insurance Embraces Advanced Technology to Tackle Weather and Cyber Risks

Property and casualty insurers are adopting AI and aerial imagery to address climate challenges, cybersecurity concerns, and improve underwriting accuracy, according to a Nearmap report.

November 20, 2024

Catastrophe

Property

Risk Management

Technology

Transforming Claims with Technology: Predictive Analytics and Machine Learning

Predictive analytics and machine learning are reshaping insurance claims management by enhancing efficiency, detecting fraud, and improving customer satisfaction.

November 18, 2024

Fraud

Insurance Industry

Risk Management

Technology

Michigan Workers’ Comp Reforms Could Reshape Benefits and Disability Rules

Proposed Michigan legislation seeks to redefine workers’ compensation laws by increasing benefit caps, revising the definition of disability, and eliminating distinctions between total and partial disabilities.

November 18, 2024

Insurance Industry

Legislation & Regulation

Risk Management

Workers' Compensation

Michigan

Jacksonville Insurance Employees Arrested for $1.14M Fraud Scheme

Two Jacksonville healthcare employees allegedly submitted over 40 false claims, defrauding their employer of $1.14 million from 2019 to 2023. Both face serious charges.

November 18, 2024

Fraud

Insurance Industry

Legislation & Regulation

Risk Management

Florida

Insurers Turn to AI Models to Tackle Rising Losses from Extreme Weather

A ZestyAI survey reveals growing confidence in AI risk models, with insurers emphasizing the importance of innovation in addressing climate-related challenges and profitability.

November 18, 2024

Catastrophe

Insurance Industry

Risk Management

Technology

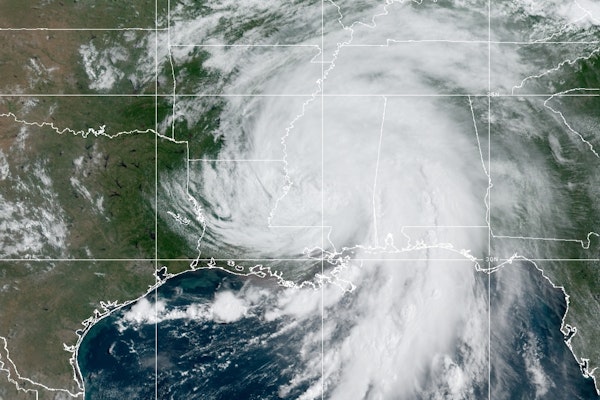

Navigating Flood Insurance Challenges After Hurricanes Helene and Milton

Hurricanes Helene and Milton highlight significant issues in the U.S. flood insurance market, showcasing the gaps in coverage, private market growth, and lessons from Florida’s response.

November 18, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

OSHA Reports Fewer Worker Fatalities Investigated in 2024

Worker fatalities investigated by OSHA decreased by 11% in FY 2024, marking the lowest count since 2017. Efforts targeting falls and trench collapses significantly contributed to the decline.

November 18, 2024

Insurance Industry

Legislation & Regulation

Risk Management

Workers' Compensation

Flood Insurance Gaps Highlighted by Hurricane Helene’s Impact

The devastation caused by Hurricane Helene sheds light on the widespread lack of flood insurance, revealing critical challenges in accessibility, affordability, and risk awareness.

November 18, 2024

Legislation & Regulation

Property

Risk Management

Florida

Louisiana

Texas

Cybercrime on the Rise: Most Americans Report Scam Attempts

A recent report highlights that nearly all Americans have been targeted by digital scams, with billions lost annually to sophisticated cybercrime schemes.

November 15, 2024

Fraud

Insurance Industry

Risk Management

Technology

AI Revolutionizes Hurricane Forecasting with Unprecedented Accuracy

AI weather models like GraphCast demonstrated remarkable accuracy during this hurricane season, outperforming traditional models in predicting storm tracks but facing challenges with intensity forecasting.

November 15, 2024

Catastrophe

Risk Management

Technology

Louisiana

Texas

Worker Deaths Decline as OSHA Focuses on Safety Enforcement and Education

A new OSHA report shows an 11% drop in worker fatalities, with significant declines in deaths from trench collapses and falls, attributed to targeted safety efforts, enforcement, and outreach initiatives.

November 14, 2024

Education & Training

Legislation & Regulation

Risk Management

Workers' Compensation

New Climate Research Reveals Worsening Global Conditions in 2024

As COP29 unfolds in a year of record-high temperatures, new research reveals accelerating climate effects, from supercharged storms and wildfire deaths to a slowing Atlantic current, raising concerns about a range of tipping points.

November 14, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

North Carolina

Massachusetts Wildfires Spread as Drought and High Winds Intensify Risks

Ongoing drought and high winds have sparked severe brush fires across Massachusetts, with over 1,500 acres already burned this season. Officials urge caution as red flag warnings remain in place.

November 14, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Maine

Massachusetts

New Hampshire

GM Issues Recall on Diesel Pickups and SUVs Over Rear Wheel Lock-Up Risk

General Motors is recalling nearly 462,000 Chevrolet, GMC, and Cadillac vehicles with diesel engines due to a defect in the transmission control valve that could cause rear wheels to lock up, raising crash risks.

November 14, 2024

Auto

Legislation & Regulation

Risk Management

Technology

UK Class Action Alleges Apple Monopolizes Data Storage, May Face Billions in Damages

Apple faces a UK class action alleging it unfairly dominates the data storage market by limiting consumer options for external storage. The lawsuit, filed in London, seeks up to £3 billion in damages and highlights ongoing concerns over monopolistic practices by tech giants.

November 14, 2024

Legislation & Regulation

Litigation

Risk Management

Technology