AIG Issues Its First ESG Report

American International Group (AIG) has done something it has never done before – release an environmental, social, and governance (ESG) report – which AIG president and chief executive Peter Zaffino said is part of the insurer’s transparency pledge.

July 1, 2021

Risk Management

The Many Victims of "Mostly Peaceful Demonstrations"

As I was watching the morning news, I heard some pundits, who obviously had no idea about insurance, claim that those people whose businesses, buildings, and inventories were destroyed by fire, vandalism, and theft during the so-called mostly peaceful demonstrations were not victims, nor were they harmed, because they were indemnified by insurance.

June 30, 2021

Risk Management

Return to Work: How P&C Industry Workers Feel About Workplace Safety

Fears about COVID-19 infections in the workplace, questions about safety precautions, and concerns about vaccination rates are key reasons why some property and casualty insurance professionals say they are not enthused about a return to the office.

June 28, 2021

Risk Management

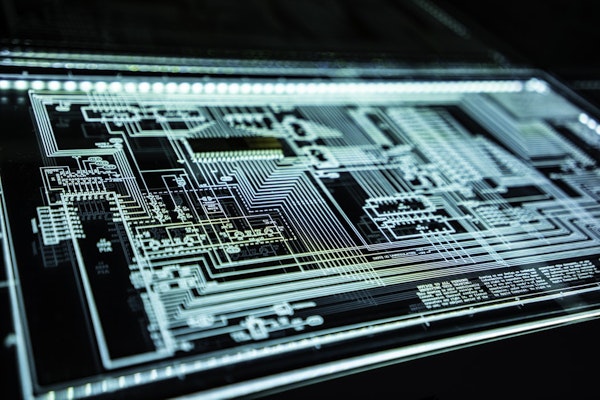

From Risk Transfer to Risk Prevention

Recent developments in technology and the corresponding availability of data can improve risk prevention. A key driver is the Internet of Things (IoT), the growing network of connected devices ranging from consumer wearables to industrial control systems.

June 25, 2021

Risk Management

Technology

Billions in Possible Liability Exposures for PFA Manufacturers as Regulatory Attention Ratchets Up

Early in June, Senator Kirsten Gillibrand and Representative Antonio Delgado (both D-NY) reintroduced legislation that would regulate per- and poly-fluoroalkyl substances (PFAS) under the Clean Water Act.

June 17, 2021

Liability

Risk Management

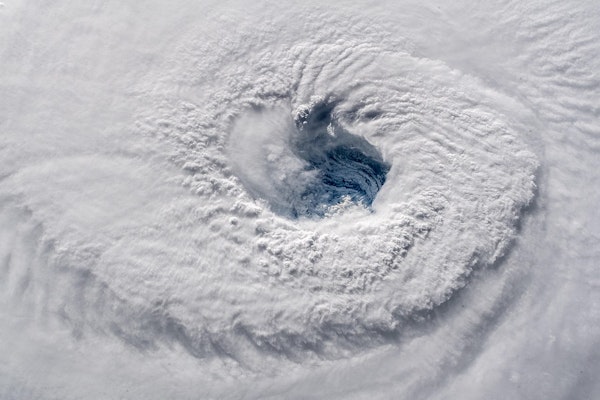

Climate is Single Biggest Opportunity for Re/Insurers: John Neal

Lloyd’s CEO John Neal has described climate change as ‘the largest single underwriting and investment opportunity’ that most re/insurers will see in their careers.

June 16, 2021

Risk Management

UN Secretary General Guterres Warns of Insurance Industry ‘Race Against Time’

In UN Secretary-General António Guterres’ closing remarks at the Insurance Development Forum held virtually earlier this week, he asserted that the insurance industry is in a ‘race against time’ to make the adaptations necessary for adapting to the speed of climate change.

June 14, 2021

Risk Management

Owning the Natural Disaster Preparedness and Recovery Process

Increasingly severe and frequent weather events have devastated new regions of the country and no longer seem to follow a formal seasonal pattern.

June 9, 2021

Risk Management

The Promise of Predictive Models

An innovation strategy around big data and artificial intelligence will uncover insights that allow smart carriers to acquire the most profitable clients and avoid the worst. Companies that develop the best portfolios of risks will ultimately enjoy a flight to quality while those left behind will compete for the scraps of insurability.

June 8, 2021

Risk Management

Underwriting

Allianz Affirms Environmental Commitment

Many insurers are ruling out coverage for coal businesses as they become more concerned about the environment and the impacts of climate change on the industry. Now, insurance giant Allianz Group (Allianz) has affirmed its commitment to refusing to support the thermal coal industry.

June 4, 2021

Risk Management

Pay Up or Shut Down?

It had been simmering beneath the surface for some time. The profound increase in frequency and severity of ransomware attacks on U.S. businesses in every sector was impossible not to notice.

June 3, 2021

Excess & Surplus Lines

Risk Management

Crossroads: Where Security And Privacy Regulations Meet Cyber Insurance

In 2020 alone, industries across the board experienced a total of 1001 reported cases of data breaches. It’s no secret that businesses need to comply with security and privacy regulations defined by the states and countries they operate in, by their industry or by the type of audience and customers they work with.

June 2, 2021

Legislation & Regulation

Risk Management

Workplace ‘Turnover Tsunami’ is Brewing as COVID-19 Subsides

Work conditions during the COVID-19 pandemic have created the perfect storm for a ‘turnover tsunami,’ a Hub International speaker suggested during a webinar last week.

May 28, 2021

Risk Management

How the Insurance Industry Could Bring Down Fossil Fuels

Late last year, Lloyd’s of London announced plans to stop selling insurance for some types of fossil fuel companies by 2030.

May 28, 2021

Excess & Surplus Lines

Risk Management

Underwriting

Three More Florida Property Insurers Cancel Policies

Three Florida property insurance companies have added their names to the list of insurers that have been cancelling policies in the state due to hurricane claims.

May 20, 2021

Catastrophe

Risk Management

Florida