Hanover Ordered to Pay Rock Singer $2 Million After Memphis Studio Fire Dispute

A federal court ruled Hanover must pay $2 million to rocker John Falls, finding the insurer wrongly denied coverage after a 2015 Memphis studio arson and policy dispute.

September 29

Fraud

Insurance Industry

Litigation

Property

Tennessee

Live Nation and Ticketmaster Sued for Enabling Ticket Brokers and Overcharging Fans

The FTC and seven states allege Live Nation and Ticketmaster enabled brokers to bypass ticket limits, reaping billions in fees while fans paid inflated resale prices.

September 22

Legislation & Regulation

Litigation

Risk Management

Technology

California

Colorado

Florida

Illinois

Nebraska

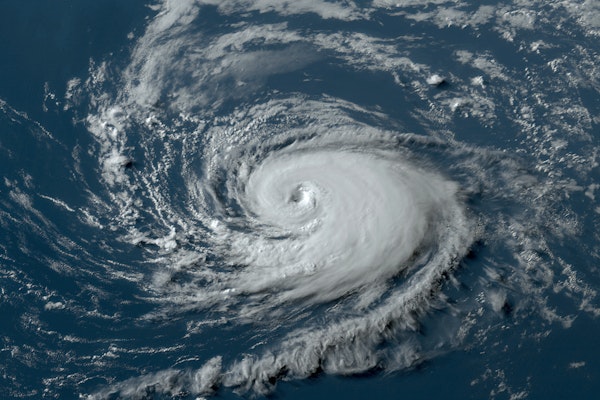

Why the Atlantic Hurricane Season Has Suddenly Gone Quiet in September

Despite reaching the statistical peak of hurricane season, the Atlantic basin is unusually quiet this September, with no active storms and limited tropical development expected.

September 10

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

North Carolina

Tennessee

Texas

Camaro ZL1 Becomes Top Target for Thieves as Muscle Car Thefts Surge

Chevrolet Camaro ZL1 tops latest HLDI rankings for whole-vehicle thefts, with theft rates nearly 40 times the average; Hyundai and Kia see results from anti-theft software.

August 20

Auto

Property

Risk Management

Technology

California

Maryland

Mississippi

Tennessee

Texas

Nationwide Auto Theft Ring Busted as Queens DA Charges 20 in $4.6M Scheme

Prosecutors say a sophisticated criminal network used social media to resell 126 stolen cars in a multi-state operation that spanned from New York to Tennessee.

May 9

Fraud

Litigation

Risk Management

Technology

Massachusetts

New Jersey

New York

Tennessee

Historic Flooding Threat Intensifies Across Central US After Devastating Storms and Tornadoes

Following deadly tornadoes and widespread storm damage, central US states now face a rare high-risk flood event that could bring once-in-a-generation impacts.

April 4

Catastrophe

Property

Arkansas

Indiana

Kentucky

Mississippi

Missouri

AI Analysis Reveals $2.15 Trillion in US Property at Risk from Wildfires

A new AI-driven study by ZestyAI finds that $2.15 trillion worth of U.S. residential property is at high risk of wildfire damage, affecting millions of homes beyond historically fire-prone regions.

February 27

Catastrophe

Insurance Industry

Property

Underwriting

California

Colorado

Kentucky

North Carolina

South Dakota

Fast-Food Workers Face Growing Risks as Customer Violence Escalates

As fast-food employees prepare meals, they also face an increasing risk of customer aggression. Recent violent incidents highlight the dangers of frontline service jobs.

February 14

Legislation & Regulation

Liability

Risk Management

Workers' Compensation

Michigan

Oregon

Tennessee

Natural Disasters Caused $368 Billion in Damage Last Year, Aon Report Reveals

The 2025 Climate and Catastrophe Insight Report by Aon highlights how hurricanes, severe storms, and global flooding pushed disaster losses to $368 billion in 2024, exposing critical insurance gaps.

January 29

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

North Carolina

South Carolina

Tennessee

Is 3D Printing Transforming Construction?

Innovative 3D printing technology is reshaping residential and commercial construction, offering faster, cost-effective, and sustainable solutions to address the housing shortage.

December 26, 2024

Litigation

Property

Risk Management

Technology

Florida

Nevada

Tennessee

Texas

CVS Faces Federal Lawsuit Over Alleged Opioid Dispensing Missteps

The DOJ alleges CVS pharmacies knowingly dispensed opioids unsafely, ignoring red flags and understaffing stores, as part of a whistleblower suit under the False Claims Act.

December 19, 2024

Fraud

Legislation & Regulation

Litigation

Risk Management

Rhode Island

Tennessee

Texas

Florida Matches Record Hurricane Landfalls in 2024, Reports Howden Re

The 2024 Atlantic hurricane season, marked by record Florida landfalls and extreme storm activity, ranks among the most impactful in recent history, Howden Re reports.

December 5, 2024

Catastrophe

Property

Risk Management

Technology

Florida

North Carolina

Tennessee

Rising Inland Flood Risk Demands Urgent Attention in U.S.

The Insurance Information Institute’s latest report highlights the increasing flood risks faced by inland areas due to shifting weather patterns. Hurricanes, tropical storms, and thunderstorms are pushing the boundaries of flood-prone regions, underscoring the need for better insurance coverage, flood resilience, and mitigation strategies to bridge the protection gap in non-coastal communities.

November 14, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

Florida

Georgia

Kentucky

New Jersey

New York

Florida Hurricane Damage Claims Reach $4.775 Billion After Hurricanes Helene and Milton

Insurance claims in Florida from Hurricanes Helene and Milton have reached $4.775 billion, up $169 million from last week’s total. The storms have left extensive residential and commercial property damage, according to the Office of Insurance Regulation.

November 12, 2024

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Florida

Georgia

North Carolina

South Carolina

Tennessee

Widespread Flooding from Hurricane Helene Spotlights Inland Insurance Gaps

The devastation from Hurricane Helene reveals a significant inland flood-protection gap, particularly in flood-prone communities without sufficient insurance coverage, where misinformation and funding challenges further slow recovery efforts.

October 28, 2024

Catastrophe

Insurance Industry

Legislation & Regulation

Risk Management

Florida

Georgia

Kentucky

New Jersey

New York