How Construction Defect Claims in Florida Expand Beyond Pre-Suit Notices

Florida’s Chapter 558 pre-suit process aims to reduce litigation in construction disputes, but procedural loopholes often leave contractors facing broader claims mid-litigation.

September 18

Legislation & Regulation

Litigation

Property

Risk Management

Florida

Man Dies After Losing Consciousness on Stardust Racers Ride at Universal’s Epic Universe

A man in his 30s died after becoming unresponsive on the Stardust Racers ride at Universal’s Epic Universe. The attraction remains closed amid an ongoing investigation.

September 18

Catastrophe

Legislation & Regulation

Liability

Risk Management

Florida

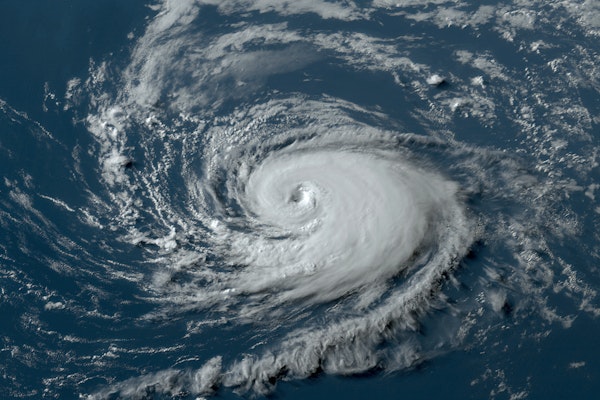

Why the Atlantic Hurricane Season Has Suddenly Gone Quiet in September

Despite reaching the statistical peak of hurricane season, the Atlantic basin is unusually quiet this September, with no active storms and limited tropical development expected.

September 10

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

North Carolina

Tennessee

Texas

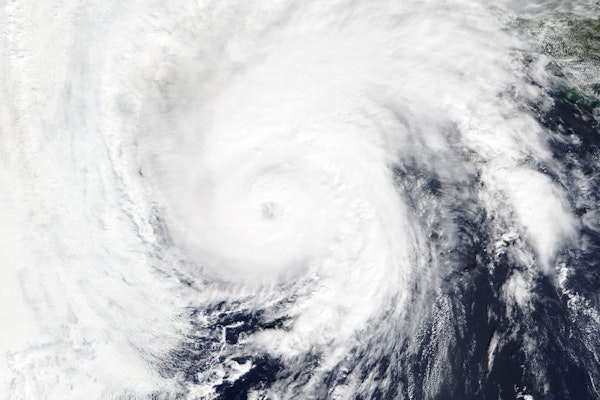

How a $100 Billion Hurricane Could Strike the US and What Insurers Need to Know

Major U.S. metro areas are increasingly vulnerable to $100 billion hurricane losses. This KCC report shows where it’s most likely and how insurers can prepare for the next big one.

August 29

Catastrophe

Insurance Industry

Property

Risk Management

Connecticut

Florida

Louisiana

Massachusetts

New Jersey

How Subcontractors’ Carriers Can Push Back Against Excessive Builder Demands in Florida Claims

In Florida construction-defect cases, subcontractors’ carriers often face inflated demands from builders. Strategic defense can limit exposure to excessive defense cost claims.

August 26

Insurance Industry

Liability

Litigation

Florida

Key Loss Adjusting Trends Shaping Property Claims in 2025

Sedgwick’s 2025 Loss Adjusting Insights Report explores the top nine trends—from tariffs and tech to legislation and climate change—reshaping property claims today.

August 25

Catastrophe

Legislation & Regulation

Property

Technology

California

Florida

Hawaii

Illinois

Iowa

JPMorgan Must Defend Elder Fraud Arbitration Claim from Widow

A federal judge ruled that JPMorgan must face arbitration over claims it failed to prevent a widow’s son from stealing $8.4 million from her bank accounts after her husband’s death.

August 20

Fraud

Legislation & Regulation

Litigation

Risk Management

California

Florida

Massachusetts

New York

Hurricane Erin Threatens East Coast with Life-Threatening Surf and Evacuations Ordered in North Carolina

Hurricane Erin, now a powerful Category 4 storm, is forecast to bring dangerous surf and rip currents to the eastern U.S., prompting mandatory evacuations in coastal North Carolina.

August 18

Catastrophe

Insurance Industry

Property

Risk Management

Florida

North Carolina

Delivery Drones Are Expanding Rapidly as Safety, Cost, and Regulatory Challenges Persist

As FAA regulations evolve, drone delivery is scaling to more U.S. cities, though high costs, airspace safety, and privacy concerns continue to slow full adoption.

August 14

Legislation & Regulation

Property

Risk Management

Technology

Arizona

Florida

Georgia

Kansas

Missouri

Record-Breaking Insured Losses in 2025 Highlight Growing Impact of U.S. Wildfires and Storms

The first half of 2025 brought $84 billion in insured catastrophe losses, driven by U.S. wildfires and severe convective storms, making it the costliest H1 since 2011.

August 14

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

New Jersey

New York

North Carolina

Tropical Storm Erin on Track to Become Hurricane with Impacts Likely in Northern Caribbean

Tropical Storm Erin may strengthen into a hurricane by Friday, with potential impacts including high surf and rip currents in the northern Leeward Islands, Virgin Islands, and Puerto Rico.

August 14

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Florida Health Officials Urge Caution After Raw Milk Sickens Over 20 People

Florida officials are warning consumers after more than 20 people, including children, fell ill from drinking raw milk linked to a single farm in the state.

August 5

Insurance Industry

Legislation & Regulation

Life & Health

Risk Management

Florida

Florida Insurance Agent Sentenced for Premium Theft and Civil Misconduct

A former Florida insurance agent is now behind bars after stealing client premiums and facing multiple lawsuits, including a major Hurricane Ian-related judgment.

August 5

Fraud

Insurance Industry

Litigation

Property

Florida

Tesla Held Partly Liable in Fatal Florida Autopilot Crash, Jury Awards $243 Million

A Miami jury found Tesla partially responsible for a 2019 crash involving its Autopilot feature, awarding over $240 million in damages to the victims and their families.

August 4

Auto

Liability

Litigation

Technology

Florida

Quiet Start to 2025 Hurricane Season May Be Deceiving as Forecasters Predict Spike in Storms Ahead

Although the Atlantic hurricane season began quietly, meteorologists warn that most tropical activity typically occurs after August 1 and that conditions are ripe for storms ahead.

August 1

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Louisiana