Former New Orleans Police Officer Indicted in Botched Art Insurance Scam

A former New Orleans police officer faces up to 75 years in prison for orchestrating a fraudulent art heist insurance claim worth $128,500.

July 8, 2024

California

Louisiana

Nevada

Escalating Home Insurance Costs Linked to Disaster Risk: Insights from Mortgage Escrow Data

An analysis of 47 million homeowners’ insurance expenditures reveals a sharp increase in premiums from 2020 to 2023, with disaster-prone areas experiencing the most significant hikes due to rising reinsurance costs.

July 1, 2024

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Louisiana

Texas

Lightning-Related Insurance Claims Soar in 2023

The Insurance Information Institute (Triple-I) reported a 30% increase in total claims value from 2022, highlighting the financial impact of severe convective storms.

June 19, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

California

Florida

Georgia

Louisiana

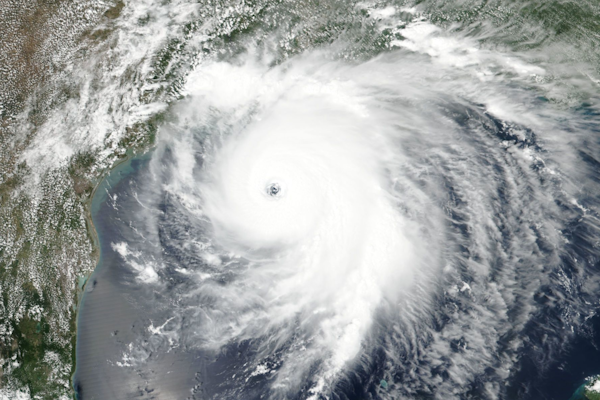

Heavy Rains Aim for Texas and Louisiana as Tropical System Brews in Gulf of Mexico

AccuWeather hurricane experts are monitoring the southwestern Gulf of Mexico for potential tropical development this week.

June 17, 2024

Catastrophe

Property

Risk Management

Florida

Louisiana

Texas

Lex Machina Reports Trends in Insurance Litigation for 2024

Lex Machina, a LexisNexis company, has released its 2024 Insurance Litigation Report, providing an in-depth analysis of trends in federal district and appellate courts from 2021 to 2023.

June 17, 2024

Insurance Industry

Liability

Litigation

Property

Louisiana

Texas Hit by Severe Storms, Leaving Over 750,000 Without Power

Powerful storms swept through Texas on Tuesday, causing over 750,000 power outages and significant damage, especially in the Dallas-Fort Worth area, with further severe weather expected throughout the day.

May 28, 2024

Catastrophe

Property

Risk Management

Technology

Florida

Louisiana

Oklahoma

Texas

Florida’s Property Insurance Market Shows Signs of Stabilization in 2024

The Florida Office of Insurance Regulation reports a downward trend in property insurance rates for 2024, indicating market stabilization due to recent reforms.

May 21, 2024

Insurance Industry

Legislation & Regulation

Property

Risk Management

Florida

Georgia

Hawaii

Louisiana

Houston Power Outages Could Last Weeks After Deadly Hurricane-Force Winds

Power outages in Houston could last for weeks following a destructive storm with hurricane-force winds, leaving thousands without electricity amid soaring temperatures.

May 17, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Alabama

Florida

Georgia

Louisiana

Mississippi

Underinsured Motorist Rates Remain High Across the US

Nearly 16% of U.S. drivers in 2022 were underinsured, unable to fully cover damages or injuries caused in accidents, highlighting a significant insurance gap.

April 24, 2024

Auto

Liability

Colorado

District Of Columbia

Georgia

Kentucky

Louisiana

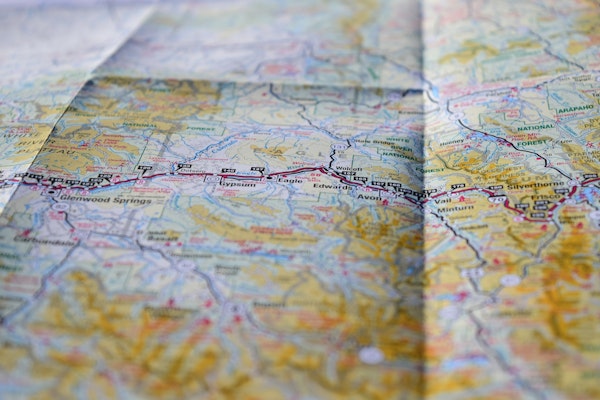

Harnessing Geospatial Technology for Enhanced Risk Assessment in the Insurance Sector

Discover how geospatial technology revolutionizes risk profiling and pricing in insurance, offering precise mapping to predict and manage risks.

April 19, 2024

Auto

Property

Risk Management

Technology

Florida

Louisiana

Texas

Record Vehicle Thefts in 2023: A Nationwide Analysis

A record 1,020,729 vehicles were stolen across the U.S. in 2023, with California and the District of Columbia leading in numbers and rates, respectively.

April 18, 2024

Auto

Catastrophe

Insurance Industry

Colorado

Delaware

Florida

Georgia

Illinois

Soaring Home Insurance Premiums: The Hidden Cost of Climate Change

A homeowner’s discovery: rising construction costs and increasing weather-related damages drive unprecedented hikes in home insurance premiums.

April 17, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Florida

Iowa

Louisiana

North Carolina

Independent Adjusters Face Industry Shifts Amid Quality Concerns and Carrier Changes

The adjuster community on Reddit discusses the evolving landscape of independent adjusting, sharing personal experiences and perspectives on industry changes.

April 5, 2024

Education & Training

Insurance Industry

Legislation & Regulation

Technology

Florida

Georgia

Indiana

Kentucky

Louisiana

Insurers and Consumers Face Growing Legal Costs Amid Social Inflation

Innovative legal tactics and social inflation are driving up insurance premiums and contributing to a hidden ’tort tax’ for American households.

April 5, 2024

Auto

Insurance Industry

Legislation & Regulation

Property

California

Florida

Indiana

Kentucky

Louisiana

Tackling the Rising Threat of Snow Melt Flooding

With snow melt floods posing a growing threat in the U.S., insurance experts highlight the importance of adequate coverage and mitigation strategies.

April 3, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Arkansas

California

Illinois

Iowa

Kentucky