Senate Report Blames Climate Change for Insurance Challenges as Industry Pushes Back

The Senate Budget Committee attributes rising non-renewal rates to climate change, but insurance experts highlight other drivers like inflation, litigation, and overbuilding.

December 19, 2024

Catastrophe

Legislation & Regulation

Property

Risk Management

California

Florida

Hawaii

Louisiana

Massachusetts

Millions of Homeowners Risk Being Underinsured for Detached Structures

AI-based analysis reveals nearly half of U.S. properties have overlooked secondary structures, highlighting risks for homeowners and insurers alike.

December 19, 2024

Property

Risk Management

Technology

Underwriting

California

Georgia

Montana

North Carolina

Rhode Island

California Insurance Agent Faces Fraud Charges Over $900K Long-Term Care Scheme

A former insurance agent in Cupertino has been charged with fraud after allegedly claiming over $900,000 in long-term care benefits for herself and her father under false pretenses.

December 12, 2024

Fraud

Legislation & Regulation

Life & Health

Litigation

California

Global Insurance 2025: Navigating Challenges to Achieve Growth

The global insurance industry faces inflation, natural disasters, and shifting demographics but finds opportunities for innovation and expansion into emerging markets.

December 9, 2024

Catastrophe

Property

Risk Management

Technology

California

Florida

New York

Washington

Homeowners Face Triple Disaster Risks and Insurance Gaps

Over 33,000 U.S. homes face extreme risks from three natural disasters, exposing gaps in insurance coverage and highlighting the urgent need for multi-peril resilience planning.

December 3, 2024

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

Washington

New York High Court Enforces Uber’s Arbitration Clause Despite Preexisting Injury Lawsuit

New York’s highest court has upheld Uber’s arbitration requirement in a case involving a preexisting injury lawsuit, ruling the company’s clickwrap agreement is a valid contract.

November 26, 2024

Legislation & Regulation

Liability

Litigation

Technology

California

Connecticut

Illinois

Massachusetts

New York

Thanksgiving Travel Expected to Break Records, Says AAA

Thanksgiving travel this year is expected to surpass pre-pandemic levels, with nearly 80 million Americans traveling by car, air, and other modes, setting new records across the board.

November 22, 2024

Auto

Insurance Industry

Risk Management

California

Florida

Hawaii

New York

Washington

Rising Climate Risks Drive 13% of US Homebuyers to Consider Moving

Concerns about natural disasters and climate risks are influencing 13.7% of US homebuyers to relocate, with low-risk areas seeing faster home value growth for the first time since 2010.

November 22, 2024

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

Texas

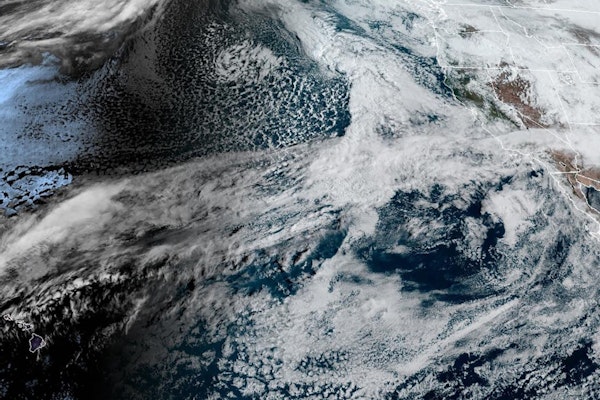

West Coast Faces Extreme Weather: Bomb Cyclone and Atmospheric River Threaten Devastation

A historic bomb cyclone brings hurricane-force winds and mass power outages to the Pacific Northwest, while a converging atmospheric river intensifies the threat with flooding rains.

November 20, 2024

Catastrophe

Property

Risk Management

California

Oregon

Washington

California Woman Receives $1 Million Settlement After Police K-9 Bite Leads to Scalp Injuries

A California city has settled a $967,000 excessive force claim after a police K-9 bit a woman’s scalp during her arrest, causing severe injuries and psychological trauma.

November 20, 2024

Insurance Industry

Liability

Litigation

Risk Management

California

Cargo Thefts Surge During Thanksgiving Holiday, Analysis Reveals

CargoNet reports a surge in cargo thefts during Thanksgiving, with high-risk areas and targeted goods revealing sophisticated criminal networks exploiting supply chain vulnerabilities.

November 20, 2024

Fraud

Property

Risk Management

California

Illinois

Allstate Seeks Repayment from Hyundai, Kia Over Vehicle Fire Claims

Allstate and subsidiaries are suing Hyundai and Kia, claiming the automakers failed to address known fire risks in certain vehicles, resulting in insurance payouts for damages related to vehicle fires.

November 14, 2024

Auto

Liability

Litigation

Subrogation

California

Fake Bear Attack Insurance Scam Leads to Arrests in California

Four Southern California residents were arrested on suspicion of insurance fraud after allegedly submitting false claims that their cars were damaged by a bear, which officials say was a person in a bear costume.

November 14, 2024

Auto

Fraud

Litigation

Risk Management

Weird

California

US Faces Mounting Losses from November Storms as Extreme Weather Intensifies

Early November storms, including tornadoes, flooding, and wildfires, caused extensive damage across multiple states, leaving insurers facing substantial losses and highlighting the rising frequency of severe weather events across the US.

November 11, 2024

Catastrophe

Insurance Industry

Property

Risk Management

Arkansas

California

Missouri

Oklahoma

California Court Reverses Verdict in Asbestos Exposure Case, Allows Sophisticated User Defense

An appellate court in California reversed a significant asbestos exposure verdict, allowing a sophisticated user defense, and remanded the case to address unresolved allocation of fault and offset issues, providing guidance on future damage recovery for the plaintiff’s loss of consortium.

November 11, 2024

Legislation & Regulation

Liability

Litigation

Workers' Compensation

California