Claims Decline as Replacement Costs Skyrocket in Q1 2025

In Q1 2025, U.S. and Canadian property claims hit a five-year low even as average replacement costs surged 46 percent year-over-year, led by California wildfire losses and rising reconstruction expenses.

June 19, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

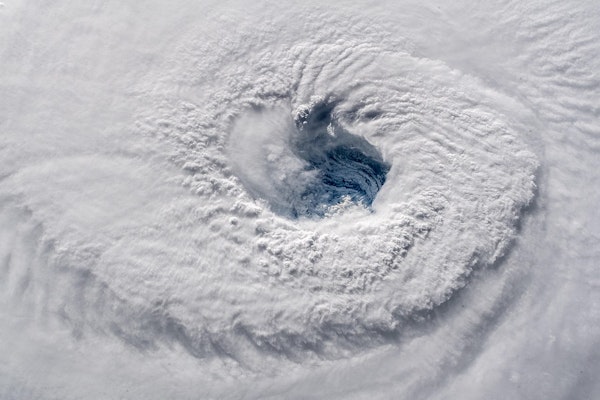

Hurricane Erick Pounds Mexican Coast with Fierce Winds and Flood Threat

Upgraded to ‘extremely dangerous’ Cat 4 before landfall, Erick made shore near Punta Maldonado with 125 mph winds, heavy rain and storm surge poised to trigger floods and mudslides.

June 19, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Google Partners with National Hurricane Center for AI-powered Tropical Cyclone Forecasts

Google is working with the National Hurricane Center to evaluate a new AI model that could enhance tropical storm predictions up to 15 days in advance.

June 12, 2025

Catastrophe

Legislation & Regulation

Risk Management

Technology

Updated Hurricane Loss Model Approved by Florida Commission

Florida’s hurricane model commission approves Karen Clark & Co.’s Version 5.0, featuring enhanced climate data, upgraded vulnerability functions, and new coverage modeling capabilities.

June 12, 2025

Catastrophe

Property

Risk Management

Technology

Florida

Natural Disasters and Legal Pressures Are Driving Up Homeowners Insurance Costs Nationwide

Homeowners insurance is becoming less affordable nationwide as natural disasters, legal system strain, and rising repair costs drive premiums higher, especially in disaster-prone states.

June 11, 2025

Catastrophe

Insurance Industry

Litigation

Property

Alaska

Florida

Louisiana

Maryland

Mississippi

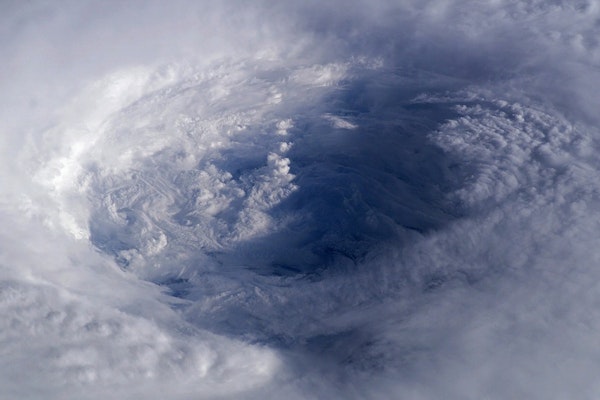

How the Insurance Industry Is Preparing for a Fierce 2025 Hurricane Season

After a season of compounding storms and inland flooding in 2024, the insurance industry is refining its storm strategies and readiness plans for a potentially active 2025.

June 11, 2025

Catastrophe

Education & Training

Insurance Industry

Property

Homeowners Take Legal Action Against USAA and AAA Insurers Over Los Angeles Wildfire Coverage Disputes

Lawsuits filed in Los Angeles County accuse USAA and AAA-affiliated insurers of underinsuring homes damaged in the January 7 wildfires, leaving policyholders unable to rebuild.

June 9, 2025

Catastrophe

Insurance Industry

Litigation

Property

California

Scientists Chase Extreme Hailstorms Across the Plains to Uncover the Costliest Weather Threat

Researchers are diving into hailstorms across Texas, Oklahoma, and Kansas to better understand one of the U.S.’s costliest but most overlooked weather risks.

June 9, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Colorado

Kansas

New Mexico

Oklahoma

Texas

Colorado Advances Wildfire Insurance with Predictive Tech Models

Starting July 2026, Colorado will let insurers use advanced risk models for wildfire coverage, aiming to price policies more accurately amid rising climate threats.

June 9, 2025

Catastrophe

Legislation & Regulation

Property

Technology

California

Colorado

How Georgia Can Tackle Rising Insurance Premiums and Loss Ratios

Georgia homeowners face surging premiums after back-to-back hurricanes. Lawmakers and insurers are exploring solutions to stabilize the market and protect consumers.

June 9, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Alabama

Arkansas

Florida

Georgia

Louisiana

Severe Storms in US and Europe Trigger Massive Insured Losses

Severe storms across the US and Europe from late May to early June caused extensive hail, flood, and wind damage, with insured losses reaching into the billions.

June 9, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Illinois

Iowa

Kansas

Missouri

Texas

Philadelphia Transit Lot Fire Destroys 40 Decommissioned Buses

A fire at a SEPTA bus lot in Philadelphia destroyed 40 decommissioned vehicles but caused no injuries or disruptions to commuter service, officials said.

June 9, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Pennsylvania

Florida Property Insurers Return to Profit in 2024 After Eight-Year Losing Streak

Following legislative reforms and shifting market dynamics, Florida’s personal property insurers posted underwriting profits in 2024 for the first time in nearly a decade.

June 4, 2025

Catastrophe

Insurance Industry

Legislation & Regulation

Property

Florida

NOAA Pushes to Fill Weather Forecasting Gaps as Staffing Crisis Collides with Hurricane Season

NOAA will post mission-critical weather jobs despite a federal hiring freeze, aiming to stabilize forecasting operations ahead of a hurricane season forecast to be severe.

June 4, 2025

Catastrophe

Legislation & Regulation

Risk Management

Technology

Slightly Stronger 2025 Hurricane Season Expected Amid Climate Uncertainty

Forecasters anticipate a slightly above-average 2025 hurricane season in the Atlantic, though key uncertainties in ENSO and sea temperatures complicate predictions.

June 4, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida