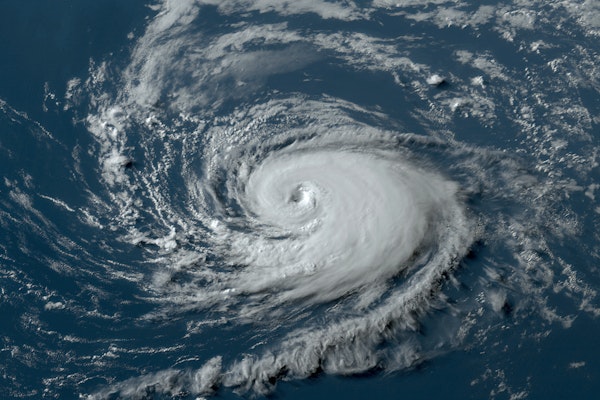

Why the Atlantic Hurricane Season Has Suddenly Gone Quiet in September

Despite reaching the statistical peak of hurricane season, the Atlantic basin is unusually quiet this September, with no active storms and limited tropical development expected.

September 10, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Florida

Georgia

North Carolina

Tennessee

Texas

Underwriting Profit Triples for U.S. Property/Casualty Insurers in Early 2025 Despite Mixed Income

The U.S. P/C insurance industry posted a $11.5B underwriting gain in H1 2025, aided by fewer Q2 catastrophes, despite a sharp decline in investment-driven net income.

September 4, 2025

Catastrophe

Insurance Industry

Property

Underwriting

California

Georgia

Texas

Insurers Seek to Void Marine Policy After Yacht Crash Off California Coast

Specialty insurers are asking a California court to void a yacht policy after a collision, alleging the insured failed to meet critical warranty and disclosure terms.

September 2, 2025

Excess & Surplus Lines

Insurance Industry

Litigation

Marine

California

Texas

How a $100 Billion Hurricane Could Strike the US and What Insurers Need to Know

Major U.S. metro areas are increasingly vulnerable to $100 billion hurricane losses. This KCC report shows where it’s most likely and how insurers can prepare for the next big one.

August 29, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Connecticut

Florida

Louisiana

Massachusetts

New Jersey

Key Loss Adjusting Trends Shaping Property Claims in 2025

Sedgwick’s 2025 Loss Adjusting Insights Report explores the top nine trends—from tariffs and tech to legislation and climate change—reshaping property claims today.

August 25, 2025

Catastrophe

Legislation & Regulation

Property

Technology

California

Florida

Hawaii

Illinois

Iowa

Camaro ZL1 Becomes Top Target for Thieves as Muscle Car Thefts Surge

Chevrolet Camaro ZL1 tops latest HLDI rankings for whole-vehicle thefts, with theft rates nearly 40 times the average; Hyundai and Kia see results from anti-theft software.

August 20, 2025

Auto

Property

Risk Management

Technology

California

Maryland

Mississippi

Tennessee

Texas

Texas Sees Sharp Rise in Catalytic Converter Theft as Criminals Target High-Value Metals

Catalytic converter thefts are soaring across Texas, with Tarrant County hit especially hard. Learn why thieves target these parts and how to protect your vehicle.

August 20, 2025

Auto

Legislation & Regulation

Property

Risk Management

Texas

Delivery Drones Are Expanding Rapidly as Safety, Cost, and Regulatory Challenges Persist

As FAA regulations evolve, drone delivery is scaling to more U.S. cities, though high costs, airspace safety, and privacy concerns continue to slow full adoption.

August 14, 2025

Legislation & Regulation

Property

Risk Management

Technology

Arizona

Florida

Georgia

Kansas

Missouri

Record-Breaking Insured Losses in 2025 Highlight Growing Impact of U.S. Wildfires and Storms

The first half of 2025 brought $84 billion in insured catastrophe losses, driven by U.S. wildfires and severe convective storms, making it the costliest H1 since 2011.

August 14, 2025

Catastrophe

Insurance Industry

Property

Risk Management

California

Florida

New Jersey

New York

North Carolina

Oklahoma Man Accused of Damaging TV Weather Radar Amid Militia Group Claims

An Oklahoma man is facing felony charges after allegedly damaging a TV station’s weather radar, with an anti-government militia group later claiming responsibility.

August 1, 2025

Legislation & Regulation

Property

Risk Management

Technology

Oklahoma

Texas

Rising Litigation Costs and Tort Reform Momentum Shape Liability Claims in 2025

Tort reform efforts in states like Georgia and Florida are reshaping the liability claims landscape in 2025, as litigation costs soar and attorney involvement rises rapidly.

August 1, 2025

Insurance Industry

Legislation & Regulation

Liability

Litigation

California

Delaware

Florida

Georgia

Louisiana

Rare Russian Earthquake Sends Tsunami Waves Across Pacific and Underscores Gaps in U.S. Flood Coverage

An 8.8 magnitude quake near Russia’s Kamchatka Peninsula triggered tsunami alerts across the Pacific, spotlighting flood insurance gaps and the unpredictability of natural disasters.

August 1, 2025

Catastrophe

Legislation & Regulation

Property

Risk Management

Alaska

Hawaii

New Mexico

Oregon

Texas

Tech Giants Battle Over Who Verifies Kids’ Ages Under New State Laws

As states pass conflicting age verification laws, Meta, Apple, and Google are clashing over who should protect children online—apps or app stores.

July 25, 2025

Legislation & Regulation

Life & Health

Risk Management

Technology

Alabama

Louisiana

Mississippi

Ohio

South Carolina

Texas Flash Floods Expose Major Insurance Gaps After $1.1 Billion Disaster

Over 120 lives lost and $1.1 billion in damages from the July 4 flash floods in Central Texas, with low flood insurance uptake leaving most homeowners to face rebuilding costs alone.

July 23, 2025

Catastrophe

Insurance Industry

Property

Risk Management

Texas

Former Insurance Executive Admits Role in Fraud That Led to Collapse of Two Companies

Jasbir Thandi admitted to falsifying financial records and misappropriating funds, resulting in over $20 million in losses and the failure of two insurance carriers.

July 21, 2025

Fraud

Insurance Industry

Legislation & Regulation

Litigation

California

Texas

Vermont